Our Approach

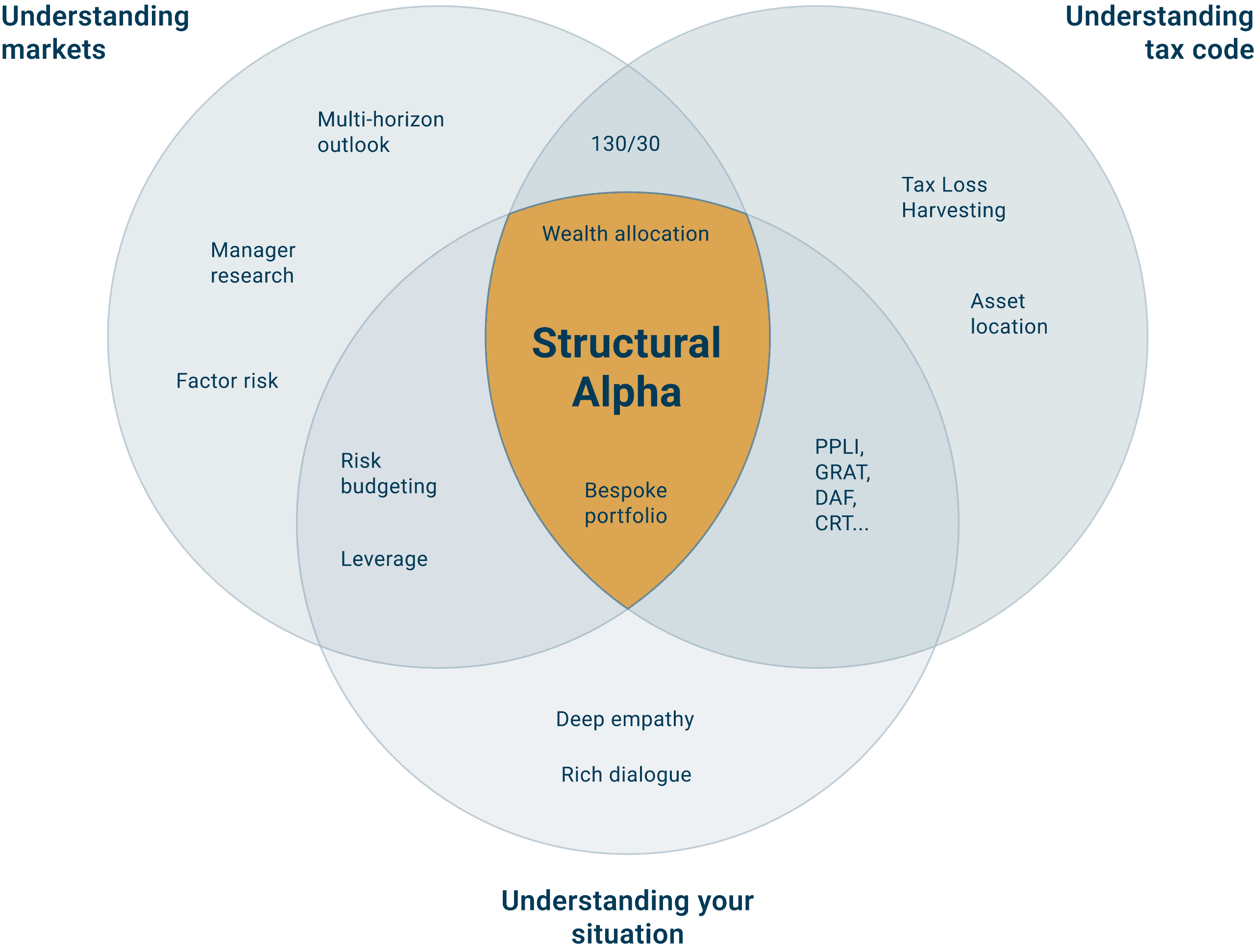

About Structural Alpha

Structural alpha often arises from deep planning. It can be enhanced by investment disciplines that align asset allocation, location and portfolio construction with the overall plan to produce distinctive outcomes.

Our proprietary Global Path Simulator (GPS) integrates market outlook, investment strategy, client goals, and tax-smart implementation. It builds upon a wealth allocation framework (Chhabra 2005) to help tailor structural alpha given your specific situation.

Wealth Allocation Framework

The Altar Rock GPS

Altar Rock’s Global Path Simulator (GPS) incorporates almost everything we know about your situation and the choices you face. It also embeds current global macroeconomic and market conditions to generate plausible paths forward to stress test your goals and unlock your full financial potential.

Investment Services

We offer a broad range of financial services through which we seek to secure your wealth goals.

Our Investment Philosophy

As life’s circumstances evolve, making the best informed decisions requires constant effort and a framework capable of understanding changing economic and market opportunities.

Initial conditions matter, as does horizon.

Markets are cyclical — so identify where we are and how far out you’re looking.

Alignment is critical.

Investing is not just about markets and returns, but also about supporting your needs, goals, purpose and values.

Rigorously triage opportunities.

Markets are fairly efficient in the short term. Reliably beating public indexes requires rare skill or structural advantage.

Cast a wide net and constantly reassess.

No cookie-cutter models here; instead craft bespoke portfolios from a wide sweep of strategies.

Build a championship team.

It is easy to create an all-star lineup; instead strive to mix and balance unique talents into a cohesive portfolio.

Trust where the research leads us.

Too many investors don't own enough of their best ideas to move the needle. Doing so requires disciplined process and an efficient tech stack.

Investment Selection Process

Our investment committee has over a century of combined market experience. We apply best practices of decision-making and carefully apply risk, liquidity, tax and fee budgets.

Capability Array (Partial)

There is almost no investment that we won’t consider owning, or at least subjecting to our risk x-ray.

Non-Investment Services

Art advisory (valuation, auctions, curation, storage)

Bill payment

Tax preparation

Credit (mortgages, loans, margin)

Data security

Personal security

Family education & governance

Health care advisory & advocacy

Legal services

Lifestyle concierge (travel, home maintenance, private aviation, maritime charter)

Philanthropy (vision, choosing charities, making gifts, non-profit governance)

Risk management aka insurance (life, term, health, disability, property)

Fiduciary Platform

Altar Rock chose to:

Be independent from any bank, broker-dealer, insurance carrier or custodian.

Never possess any client assets, securities, or money

Measure client performance returns using independent third parties

Provide transparency and access on portfolios and investments